IMCI+ supports clients on the seller and buyer side of the operations.

We were short listed for nomination as Best International M&A Advisory Partner – Global 2016 and 2018 by Capital Finance International www.cfi.co

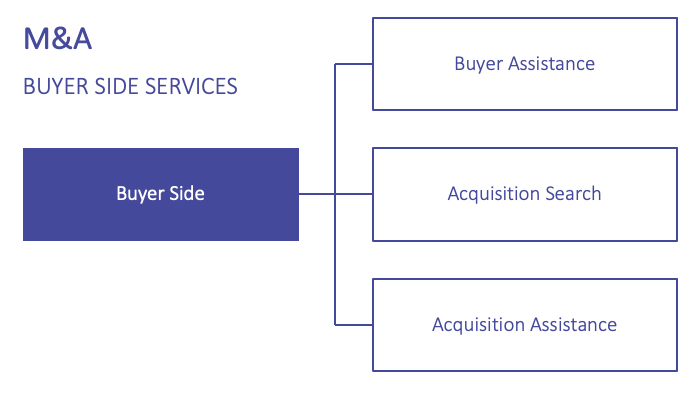

Buyer Side

+ Investment Group seeking portfolio opportunities

+ Cooperation searching acquisition opportunities

+ Business with a define acquisition strategy

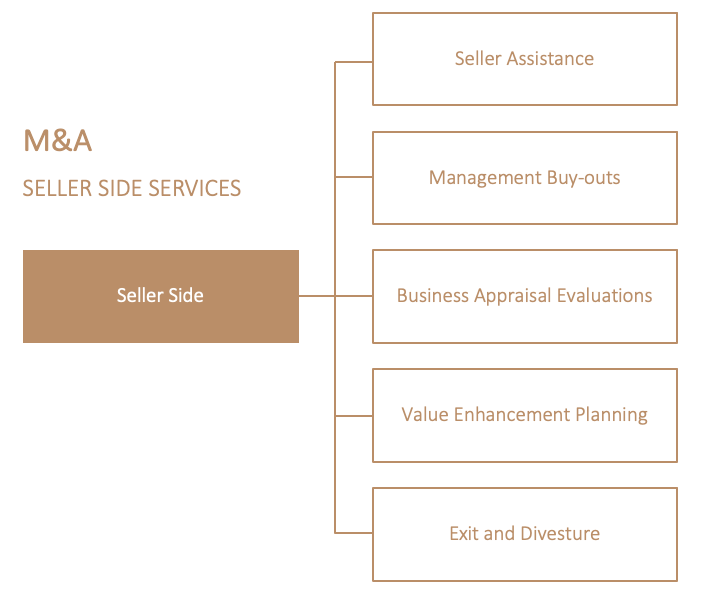

Seller Side

+ Business seeking funding. Growth, distressed, expansion.

+ Business for sale

+ Equity deals

+ Succession

Outlines of services are provided in the market

Business Buyer Assistance

Buying a business is a detailed, time-consuming process that demands expert consultation and advice. IMCI+ provides those services and much more to its buyer clients/companies, business owners or investors who want to acquire a firm with annual sales between $5 million and $100 million.

Depending on the buyer’s needs, IMC provides full acquisition search or acquisition assistance.

Full Acquisition Search

In these cases, IMCI+ develops a tailored acquisition strategy that considers the strategic fit and ideal profile of companies that you should acquire. IMCI+ examines the type of industry, revenue range, employee count, cash flow, location, valuation, management capabilities and integration risks. IMCI+ search for companies through his vast network of business owners, private-equity groups, fund managers, investors, industry associations and other relevant sources. The result is a pool of qualified companies typically not talking to other buyers.

The services include strategy development, completion of due diligence and working to ensure a timely, successful acquisition and integration plan. The client’s identity is not revealed to potential acquisition targets until or unless the client approves of the targeted company.

Acquisition Assistance

If the client (buyer) has already identified a company to acquire, he can engage IMCI+ on an hourly basis to assist in approaching, qualifying, valuing, appraising and completing the transaction. IMCI+ devises a plan to support the ownership requirements, locate sources of equity and debt to finance the purchase. IMCI+ manages the due diligence process, execute purchase agreements and complete the deal, including post-closing adjustments.

Business Seller Assistance

M&A firms are providing expertise to owners of privately held businesses who are considering selling their company. They research, analyze and prepare the client’s business for sale and then confidentially market the client’s firm to leading strategic company buyers, relevant financial buyers and private-equity groups.

M&A firms goal is to obtain a range of competitive bids and deal structures for the client to consider. At that point, they use our negotiating strength as professional dealmakers to get the transaction completed with your preferred buyer. As the M&A firm moves forward with the sale of your company, they will provide client with:

+ Business appraisal and valuation

+ Proprietary large business intelligence database

+ Professional business review, sale book and executive summary

+ Financial recasting and accounting

+ Benchmarking analysis of the client’s industry

+ Current industry research and analysis

+ Very common, International transaction experience with alliances

+ Data on recent, comparable purchase and sale transactions

Management Buyouts

Management buyouts (MBO) often involve a group of employees who want to acquire all or part of the company they operate. In some cases, the owner or owners approach the management team because they are contemplating retirement and want to leave the business in capable hands.

M&A firms guide the parties through the buyout process. They set up the financial structure of the deal, determine fair market value, identify key financial partners, conduct due diligence and keep the business relationships intact so the deal is successful. Typical reasons for purchase of a business by its existing management team include:

Certain parts of an organization no longer are seen as core areas of the business. A company is in financial distress and needs cash. Parts of acquisitions are not wanted. In a family business, succession issues involve the owner’s retirement.

Business Appraisal Valuation

Professional M&A firms regularly perform appraisals in a variety or selected types of industries, They usually have firsthand knowledge of what businesses are actually being bought and sold for.

The following three main valuation techniques are used:

» Income Approach

» Asset Approach

» Market Approach

Depending on the particular company, market conditions and the industry, the M&A firm weigh the valuation toward one or more of these methodologies. They also are guided by the client’s intentions and the purposes of the valuation. They client usually can choose from three levels of professional appraisal and valuation consulting:

» verbal valuation report

» written summary valuation

» full written appraisal and valuation

Exit and Divesture: Strategy Planning

Private business owners often contemplate selling their business long before the sale actually occurs.

The M&A firm prepare the strategic prospect of selling. In addition, they offer advice on how to increase the value of the client’s business before the sale process begins. The questions usually the M&A firm ask the clients are:

» Do you want to sell to the highest bidder or are you leaving the business in the hands of family?

» Do you want to sell to a private-equity firm and retain partial ownership of the company and stay involved in the day-to-day operations?

» Or do you want out completely to satisfy other life desires?

The M&A firm prepare the leaving, the transition plan, the strategy planning options and recommend the best exit strategy.

Value Enhancement Planning

The private business owner wants the highest value possible for his company when they decide to sell.

But before selling he may want to take specific actions to enhance his company’s value so he can earn a greater return on his investment when the business sells. Some of the main drivers of business value include:

» Business Growth Strategies

» Strategic Planning

» Company Vision

» Customer Focus

» Protected Brands

The M&A firm examine each of these issues and help the client gain clarity on actions that need to be taken to increase his company’s overall value.

In addition, we use risk management and strategic planning tools to help our clients optimize and enhance their company value. We examine various options that you, the business owner, have at your disposal to make your business worth more. We offer value enhancement recommendations and then it is up to you to make the final decision.