Consultancy

Our value proposition

+ Our Management Consulting Division is focused on one thing only: Helping client be more successful. Our experts work collaboratively with the client, combining their skills, expertise, and deep experience to deliver significant, sustainable benefits and measurable ROI.

+ Client benefits from our highly capable executives, each with deep relevant experience who stay involved in every stage of the project from initiation to fruition.

+ Client receives measurable and effective results; strategy, operational improvement, start-up & market-entry, organizational effectiveness, technology enablement, change leadership, and transformation services with benefits sustainable long after our engagements are completed.

+ Client has access to our >Billions Funding Resources and high-end Financial Services, opening you the doors to effective and attractive Financial Programs.

+ Client accelerates success from our ability to quickly understand your organization, operations, and competitive situation and integrate with and support your existing teams to help you achieve more from your resources.

+ We have operations in all five continents with local and global experts to contribute on any project with best practices and an outside-in perspective on even the most challenging transformations, expansion efforts, or operational improvement initiatives.

Our key services

» Strategy Development and Implementation

» Restructuring / Business Optimization

» Expansion Support / Business Growth

» Change Management

» Board Assignments

» Business Coaching

» Interim Management

» Project Management

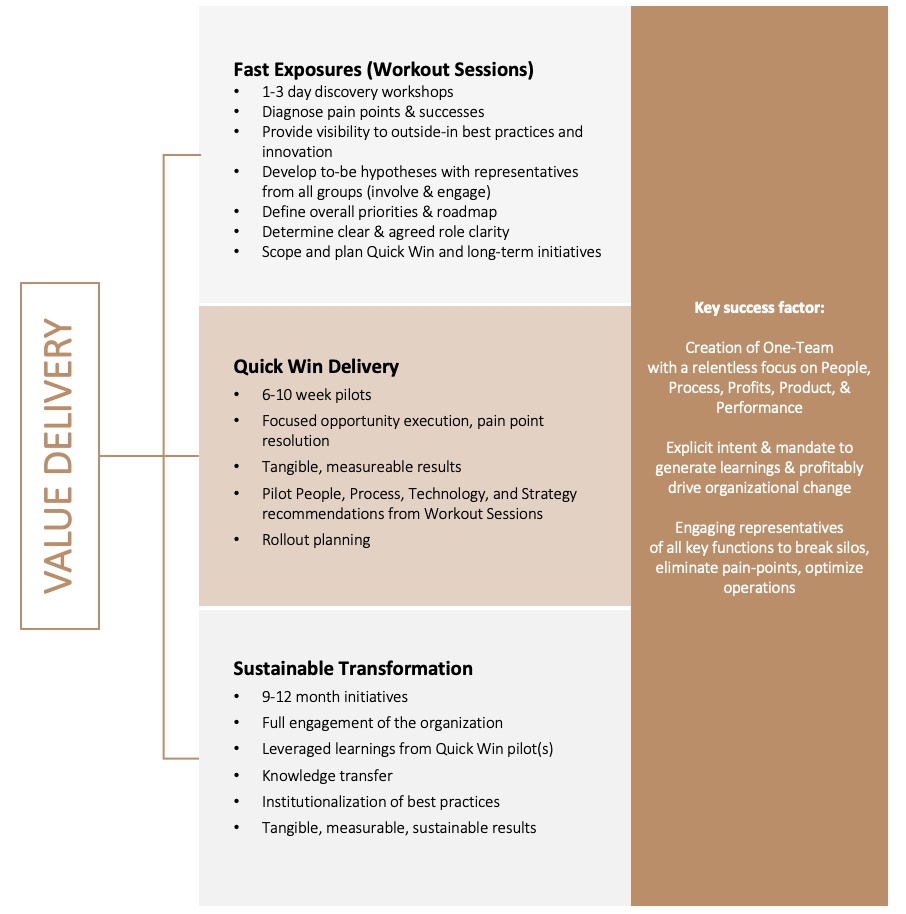

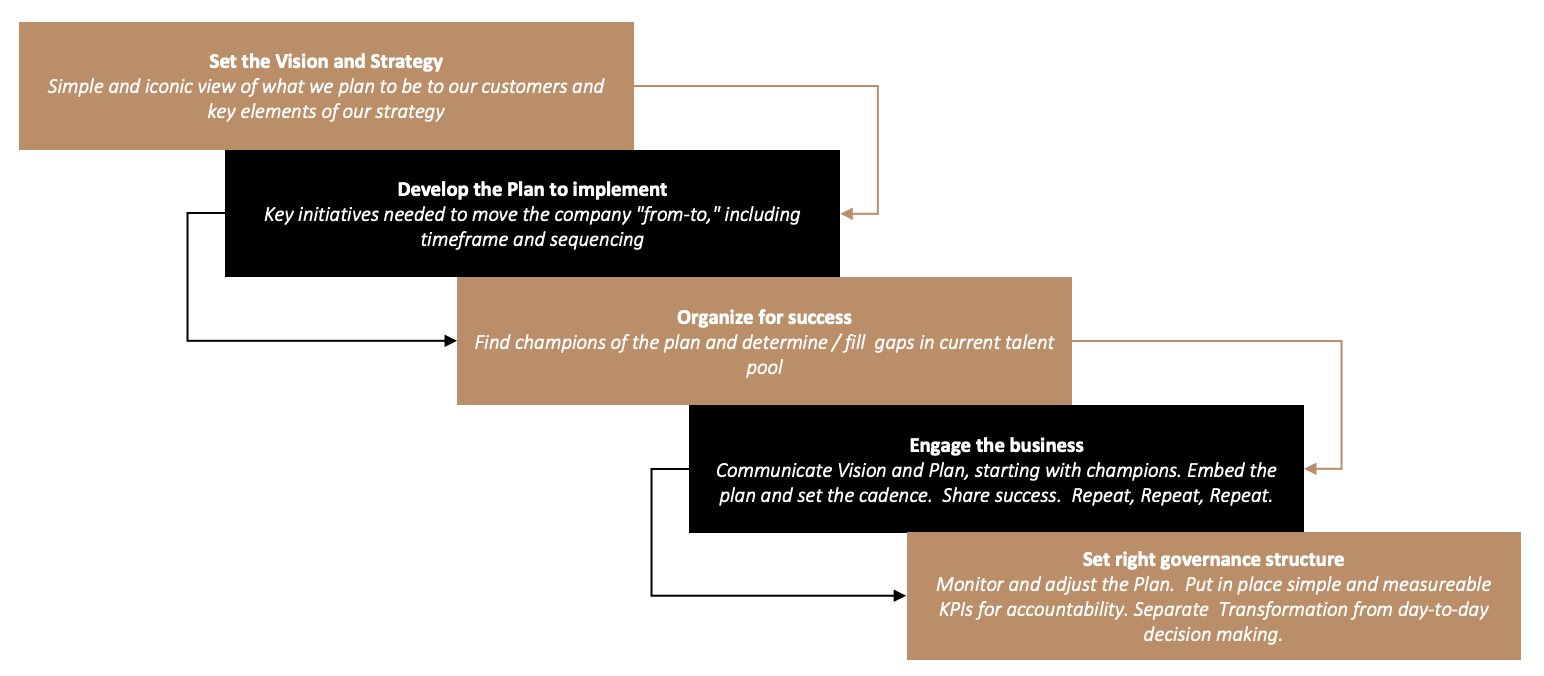

Our holistic Approach

Our methodology

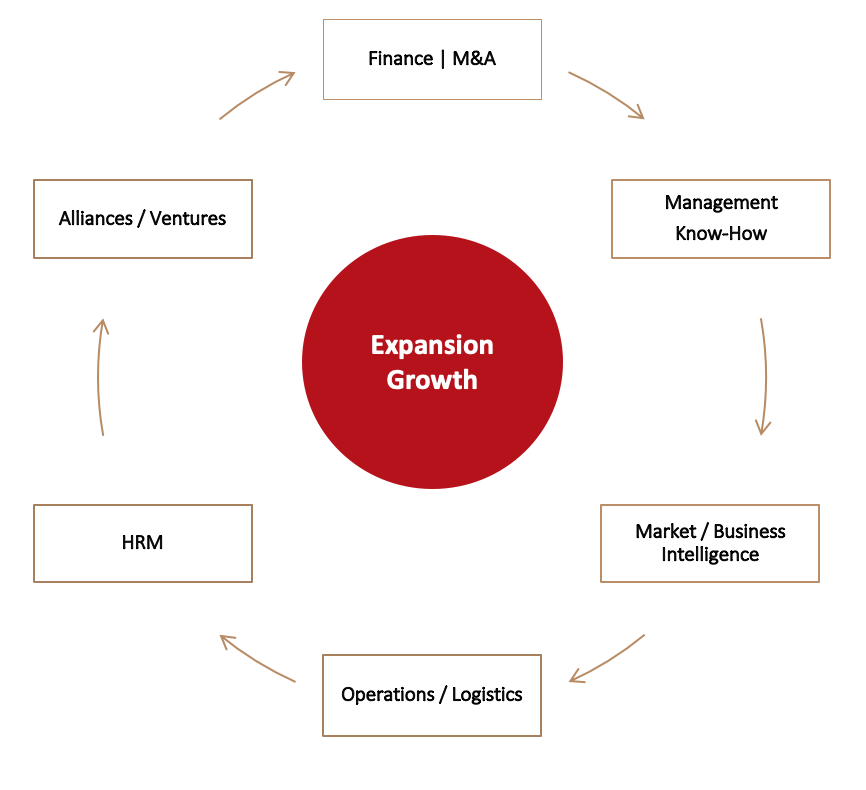

Expansion

We are delighted to supporting local and regional “champions” getting to the next level or league. This can be within a country, continent or globally.

The request is usually for financing, business intelligence, business development and management knowhow. It can be enlarged by M&A operations, searching for appropriate buy out candidates or strategic alliances. Finally also with appropriate financial support.

IMCI+ is able to create a tailored program, with clear milestones and expected outcomes.

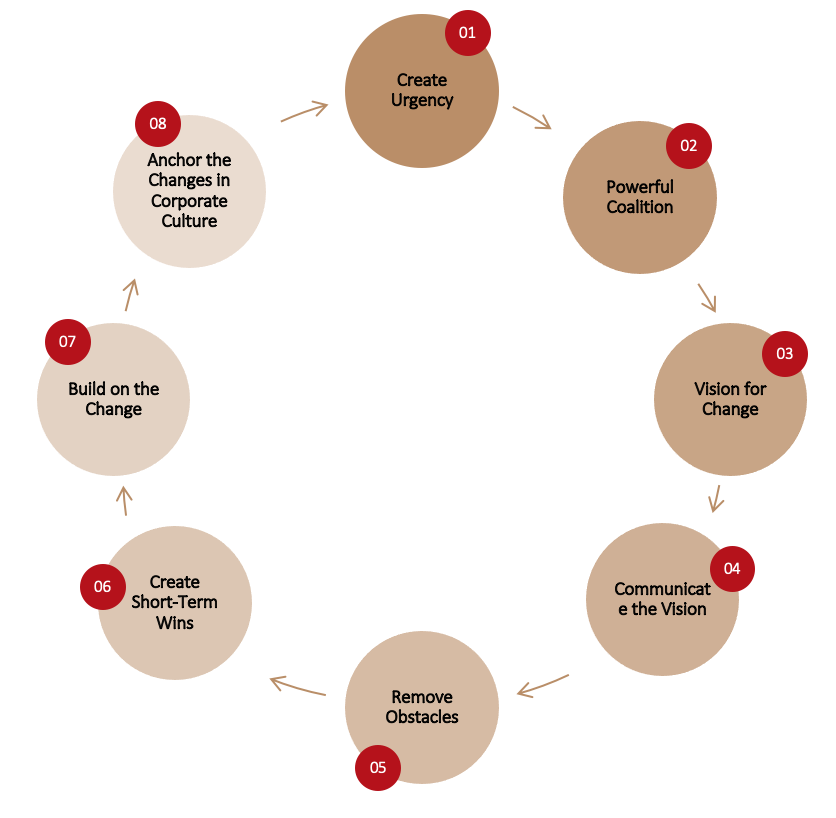

Restructuring / Transformation / Change

We apply this methodology where organizational design is at question. The most common uses of the framework are:

+ To facilitate organizational change

+ To help implement new strategy

+ To identify how each area may change in a future

+ To facilitate the merger of organization

Through:

+ Organizational alignment or performance improvement

+ Understanding the core and most influential factors in an organization’s strategy

+ Determining how best to realign an organization to a new strategy or other organization design

+ Examining the current workings and relations an organization exhibits

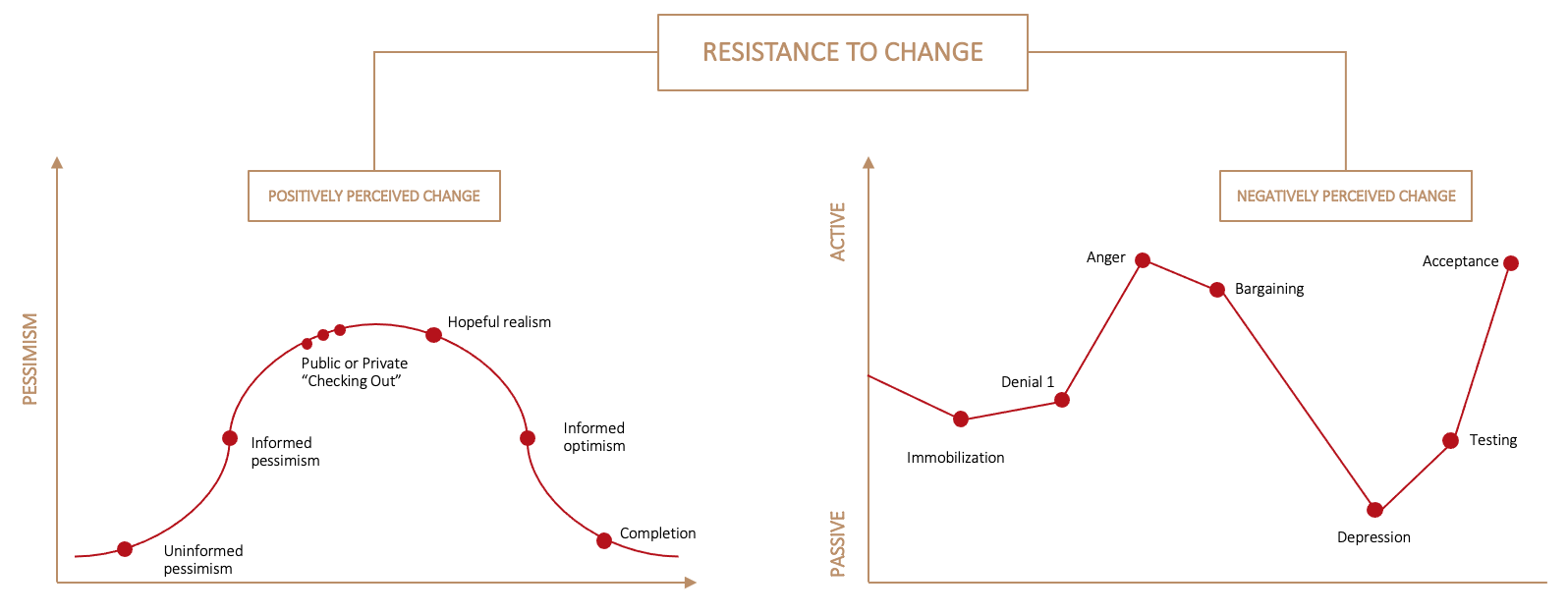

We also recognize the challenge of ‘resistance to change’ that our clients face, both internally and externally with trading partners, suppliers, alliance members when embarking on cost take-out, revenue enhancement, turnaround, expansion, or transformation initiatives needs to be addressed directly in the program plan and included as a crucial ‘people’ component of the program management office’s responsibilities.

Interim Management

The definition of interim management

According to Wikipedia, Interim management is the temporary provision of management resources and skills. Interim management can be seen as the short-term assignment of a proven heavyweight interim executive manager to manage a period of transition, crisis or change within an organization. In this situation, a permanent role may be unnecessary or impossible to find on short notice. Additionally, there may be nobody internally who is suitable for, or available to take up, the position in question.

Let’s be more practical and bolder. According to the Interim Management Association in the UK the interim manager has the following characteristics:

+ A top-level independent executive or project manager.

+ An expert in their field.

+ A high level performer with a track record of quantifiable achievement.

+ A possessor of drive and energy.

+ A perceptive individual capable of adapting to new environments and delivering results.

+ Available immediately.

In simpler terms, an interim manager is a highly experienced, in most cases at sr. executive management level and quite common, very and exceptional good in certain areas, in others top generalist, who is used to perform at the highest level, without taking care of internal politics.

Top Interim Managers are very energetic and are used to work under “electricity” and pressure. They are highly adaptable to new environments and absolutely results oriented.

Contrary to a consultant, he or she does not tell you, what to do and where the problem is, but also to solve them for you. Finally, they walk the talk. With or for you.

You can appoint our Interim Manager along the life-cycle line of your company. We will be fully dedicated to the designed mission based on success related agenda agreed with you. The length of the mandates lasts between five and ninth months.

Why choose IMCI+ as your interim manager

1.Speed. IMCI+ can be in place within days, compared to a genuine recruitment which takes 4-7 months.

2.Experience. You benefit from the cumulated experiences and similar challenges. IMCI+ will have an immediate effect minimizing the risk of things going wrong and, more importantly, ensuring success.

3.Objectivity. Unencumbered by any previous involvement in company processes, politics or staff relationships, IMCI+ will provide a fresh perspective and be free to concentrate on what's best for your business.

4.Accountability. Rather than taking on a purely advisory role (as a management consultant would), the IMCI+ interim manager is a responsible and accountable line managers who will implement and manage a business or project in his own right.

5.Effectiveness. Operating at or near board-level gives the IMCI+ interim manager the authority to effect significant change or transition within a company — unlike a temp, they're not just there to ‘hold the fort’. You will be able to measure the performance of the IMCI+ interim manager. The return of invest is usually in the range of factor 5-10 of the costs.

6.Commitment. The IMCI+ Interim manager is only committed to the success of your business and assignment.

A model how IMCI+ runs an interim management project

Phase 1: Briefing, offer and confirmation on the assignment

IMCI+ will get the big picture, scope and mile stones to achieve during the briefing session with the mandatory person who can be the CEO, president, business owner. Based on the first briefing he will propose an agenda which must be agreed on terms of resources, authorities, and expectations.

Phase 2: Preparation for the kick-off assignment

After the agreement there may follow other meetings in order to gather information on the market, the company, the operational rules, the current businesses and the staff. He will also benchmark the market, competitors, study surveys. Anything useful for a successful start.

Phase 3: Operational start of the assignment

Based on an agreement with the mandatory person and considering the nature of the mission, the IMCI+ executive will quickly prepare his arrival well to ensure that he gives an impression of authority and serenity right from the beginning. He will have to quickly implement the first levers of power: set up a management committee, build a circle of trustworthy people who will be his sources of information, etc...In this third phase, he quickly imposes his mark by setting the first rules and by taking some safe decisions.

Phase 4: Observe, analyze … and navigate at sight

When the circumstances are favorable, the transition manager takes some time to study the environment he is in charge of before determining how to achieve the defined goal.

Mostly he must act quickly though. He may even have to take important decisions right from the first day. In that case he must do everything at once and to the best of his abilities - manage, observe and analyze the company in order to be able to get to the following phase as soon as possible. Sometimes the agenda must be adapted and reviewed.

Phase 5: Action plan definition

At this stage, we will establish an action plan, considering the conclusions of Phase 4. The action plan must be a mix of ideas from the interim manager, bringing an external point of view and expertise, and the best ideas from his staff who will feel valued when their opinion has been taken into account. Sometimes circumstances need a quick reaction and priority changes. It is very important though that some actions with strong impact are carried out as soon as possible.

Phase 6: Execution and communication

Once the interim manager has established his leadership and the action plan has been announced, he will start with the core part of his mission. The action plan will remain the axis of the assignment. It can be adapted if some actions prove irrelevant or unfeasible. The interim manager will report, usually on a monthly base, its progress is to the mandatory authority the progress made to reach the objective.

Phase 7: Power transfer

Once the objectives has been achieved, the interim manager finishes his mission by transferring to the succeeding management all his knowledge regarding the entity he was in charge of, the progress report of the action plan and his advice for the future.

Project Management

The Project Management Framework and Engagement is a key universe in our Advisory Division.

IMCI+ is connected to high end teams and professionals, with decades of experience and training, certified by the highest industrial standards.

Project management methods can be applied to any project. It is often tailored to a specific type of projects based on project size, nature, industry or sector. For example, the construction industry, which focuses on the delivery of things like buildings, roads, and bridges, has developed its own specialized form of project management that it refers to as construction project management and in which project managers can become trained and certified. The information technology industry has also evolved to develop its own form of project management that is referred to as IT project management and which specializes in the delivery of technical assets and services that are required to pass through various lifecycle phases such as planning, design, development, testing, and deployment. Biotechnology project management focuses on the intricacies of biotechnology research and development. Localization project management includes application of many standard project management practices to translation works even though many consider this type of management to be a very different discipline. There is public project management that covers all public works by the government which can be carried out by the government agencies or contracted out to contractors. Another classification of project management is based on the hard (physical) or soft (non-physical) type.

Common among all the project management types is that they focus on three important goals: time, quality, and budget. Successful projects are completed on schedule, within budget, and according to previously agreed quality standards i.e. meeting the Iron Triangle or Triple Constraint in order for projects to be considered a success or failure.

For each type of project management, project managers develop and utilize repeatable templates that are specific to the industry they're dealing with. This allows project plans to become very thorough and highly repeatable, with the specific intent to increase quality, lower delivery costs, and lower time to deliver project results.

Approach:

A 2017 study suggested that the success of any project depends on how well four key aspects are aligned with the contextual dynamics affecting the project, these are referred to as the four P's:

+ Plan: The planning and forecasting activities.

+ Process: The overall approach to all activities and project governance.

+ People: Including dynamics of how they collaborate and communicate.

+ Power: Lines of authority, decision-makers, organograms, policies for implementation and the like.

There are a number of approaches to organizing and completing project activities, including: phased, lean, iterative, and incremental. There are also several extensions to project planning, for example based on outcomes (product-based) or activities (process-based).

Regardless of the methodology employed, careful consideration must be given to the overall project objectives, timeline, and cost, as well as the roles and responsibilities of all participants and stakeholders.

Board Assignment (Independent Director)

What is an Independent or Outside Director?

Usually, it is a member of a company's board of directors who was brought in from outside the company. The independent outside director has not worked with the company for a period of time , he or she is not an existing manager and is generally not tied to the company's existing way of doing business.

Outside directors are advantageous and beneficent to the company because they have very little conflict of interest. They may see the big picture differently than insiders. Finally, they are not affected by career issues and internal political affairs. The downside is that since they are less involved with the companies they represent, they may have less information upon which to base their decisions and reduced incentives to perform. Also, outside directors can face out-of-pocket liability if a judgment or settlement occurs that is not completely covered by the company or its insurance. This occurred in class-action suits against Enron and WorldCom.

Board members with direct ties to the company are called "inside directors."

The general consensus and understanding among stockholders is that independent directors improve the performance of a company through their objective view of the company's health and operations. They do not have to pander to other management personnel in order to retain their jobs. Stockholders and politicians pushed for more independent outside directors in the wake of the Enron collapse in the early part of the 2000s.

According to Wikipedia the independent director is characterized as following:

An Independent director (also sometimes known as an outside director) is a director (member) of a board of directors who does not have a material or pecuniary relationship with company or related persons, except sitting fees. Independent Directors do not own shares in the company. (Some sources state non-executive directors are different from independent ones in that non-executive director are allowed to hold shares in the firm while independent directors are not.) In the US, independent outsiders make up 66% of all boards and 72% of S&P 500 company boards, according to The Wall Street Journal.

The Value of an Independent Director for a Board

There has recently been, in our opinion, a healthy trend to include more “independent” directors on company boards. Reforms after the financial crisis in Wall Street and other stock exchanges worldwide, kicked off an awareness of the need for improved corporate governance. The subsequent trend and has led to boards looking for, and recruiting more ”independent” directors – directors who are not affiliated with any particular shareholder group, and who bring significant board, industry and management experience. But also a critic spirit and fresh air.

This trend has resulted in boards having considerably improved quality and effectiveness, as measured by various industry reports. Another point is that that business has become more and more global. It is not enough to have a good board member rooted in the block around the HQ’s, but it more and more requested having aboard international directors, who can anticipate and explain the causes and effects of the board decisions from a global perspective. Particularly for companies with branches, international partners and clients.

It requests truly leadership to a family business or a business owner, or to a President. Why? In certain cases, they must confess a weakness or admit, not knowing everything they should. In certain cases they must admit that something is going wrong and that they need help.

We suggest all family business, business owners, Presidents and CEO’s, just to see such an assignment as a huge and priceless opportunity and why not, strategy. The right independent director will not be a threat for you, nor for your family business. Contrary is the case.

You can and will reduce risk of failure and increase the chances for growing your business. As initially said. It is about to decide what kind of leader you are and why kind of leadership you want to have in your company. If you wish to have monkeys, go for it and offer bananas. If you wish to have professionals and challenges, question you. And be a true leader.

What are the real benefits of having a professional, independent director on a board?

There are some key aspects in our opinion. Also depending on the legal structure and the size of your business, but also the life-cycle where it stands today and your personal overall strategy.

1.Corporate Governance

Independent directors with extensive board experience and ongoing board education, are able to catch up quickly the hot and key legal and governance issues early. They can provide the stimulus to call the child by name and initiate any debate and constructive due diligence necessary which is part of the board. In certain cases and unfortunately too often, particularly in “family type” of boards, issues are ”presumed” to be good for the company, there is no real intention to questioning the situation and members tend to pass issues by a quick show of hands. A meaningful debate, even when there is a strong and unanimous desire to approve the issue, can protect against board liability.

2.Industrial Knowledge

Independent board members can bring an external point of view in. In most cases I have seeing, board members with an extraordinarily strong experience in the industrial sector of the company. Maybe they went through similar life-cycle situations of the firm or are aware of external trends. They are not blind, for what “we have never done it”, or “we have already tried”.

3.Management, cultural and leadership experience

I also have observed that many boards are not updated with today’s management tools, in financials or marketing subjects. Or a company which is rather local or regional, wishing to expand their business to another country or zone, is lacking linguistic or international working experience. Or in certain cases, the owner or the President is strong in certain subjects, but lacks skills and competencies in others which are vital for the development of the company. This can be particularly important when discussions with management require a second opinion on key operational or strategic points.

4.Unfiltered and unpolitical opinion

Independent board members can and should present opinions that are not tied to the interests of management or any shareholder group. They should have a free spirit. They can also bring views that may be politically difficult for other directors to discuss, given ties to shareholder groups or management.

5.Mediation, neutrality and business coach

Too often, there are different and conflicting interests around the boardroom table. A good independent director can and should be a powerful force for mediation, brokering compromises between shareholder groups, and resolving the different views between management and the board that inevitable occur.

6.Negotiating compensation, incentives and other executive agreements.

Determining appropriate executive compensation, benefits and other perquisites is always a challenge. This is especially true when family members hold leadership positions in a business. Experienced independent directors can help directly. Or under a given mission, with outside consultants to create a suitable compensation package and otherwise address the concerns of relatives who do not participate directly in day-to-day operations but may own an equity interest in the company.

As an objective third party, an independent director can also help identify potential candidates to fill positions open to non-family members and help ensure that these individuals receive a fair compensation package.

7.Credibility and Reputation

Since the collapse of Enron and other accounting scandals, corporate accountability and transparency have taken on increased importance in the eyes of investors. Private and Institutional ones. While Sarbanes-Oxley applies to public companies only, many institutional and private-equity investors, as well as lenders, are seeking similar assurances that non-public companies are also meeting proper accounting and fiduciary standards. If, for example, a privately held business is seeking outside investment, a board of directors with an independent member can help demonstrate the commitment of leadership to operate the company with the highest levels of integrity and objectivity. We have seeing many times, that either the lender / investor looks to have somebody externally aboard, giving a “kind” of guarantee or assurance. On the other side, while it comes to investment or project financing, also linked to restructuring and expansion projects, to strengthening the board with external forces, from a marketing or operational point of view, is in our eyes a must.

8.Resolving competing interests.

An independent director can also help negotiate solutions to the competing interests of family members or minority and majority shareholders. This can be especially helpful when it comes to succession planning or management.

Business Coaching

A main reason companies or executives call us for support is because they want:

1. Motivate their teams and turn them into high performing and highly motivated units

2. Communicate with authority and confidence to people at all levels

3. Be more pro-active and anticipate business problems

4. Be outstanding and inspirational leaders

5. Improve their sales performance

6. Develop planning and strategic thinking skills

7. Improve their business skills to think and act like a manager and a leader

8. Take their business to the next level

Our coaching experience and support is there where business leaders want to become more successful.

A. Leadership-Strategic Sparring Partner

IMCI+ will support you and your executives as sparring partner, throughout strategic decisions, transformations, and change situations. This can be done by running workshops, surveys, face to face talks. Depending on the task and situation you can depend on a third opinion, or actively during the construction of your business plan, budget, change management process, conflicts or other complex constellations.

B. Team-Coaching

IMCI+ can help teams grow into a single unit, goal, and common feeling. Possible situations: mobbing, integration of a new company, culture, organization, or strategy.

C. Sales-Coaching

IMCI+ can coach your sales forces effectively in sales techniques, organization or methodic.

The IMCI+ coach is a federal chartered sales and marketing manager, who can help your sales forces operate more efficient and professional.

Possible areas are:

» Single or group coaching

» Sales Trainings

» Tandem-visits

» Mystery visits

D. Executive Personal Coaching

IMCI+ can help you as a manager and person, individually to find new ways of leadership and management, especially in tough times, change, restructuration, layouts, or new orientation.

IMCI+ offers you the opportunity to see things from a 360 point of view.

In IMCI+ you will have a neutral second opinion who understands fully your position and can act as your sparring partner and coach.